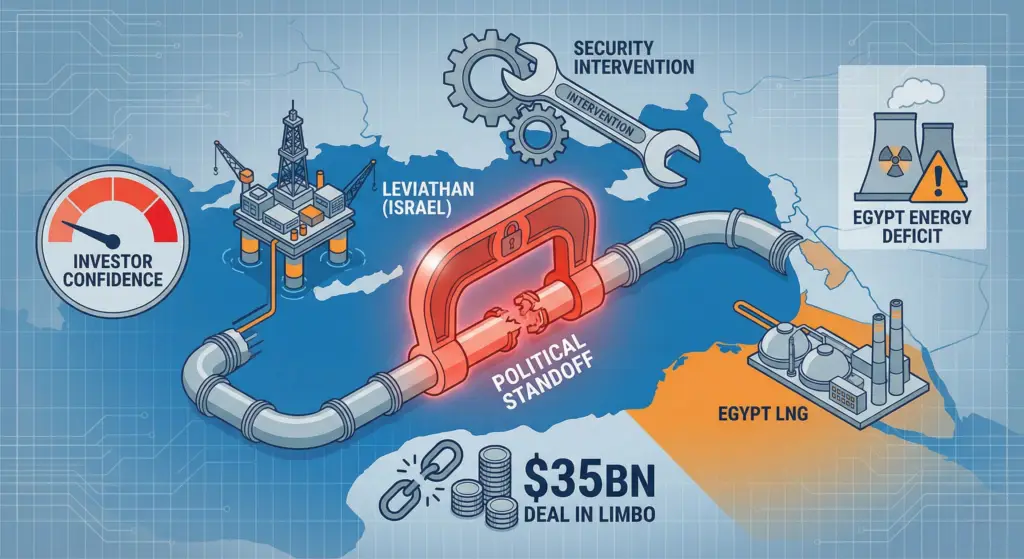

The vision of the Eastern Mediterranean as a seamlessly integrated energy hub faces its most severe stress test to date. A landmark $35 billion commercial agreement to expand natural gas exports from Israel’s Leviathan field to Egypt is currently paralyzed by political intervention. As of mid-December 2025, the deal—which involves doubling export volumes over 15 years—remains in limbo, having missed critical execution milestones.

For energy executives operating in the region, this standoff is not merely a diplomatic row; it is a material disruption to the supply/demand balance of North Africa and a signal that geopolitical risk is re-pricing regional infrastructure assets.

Context: The Interdependency Trap

The deal in question was designed to solve two problems simultaneously. Israel has a gas surplus and limited export routes (no LNG facilities of its own). Egypt has a gas deficit, soaring domestic electricity demand, and idle LNG export capacity at Idku and Damietta.

- The Plan: Chevron and its partners committed to investing heavily to expand Leviathan’s production and build a new offshore pipeline (Nitzana route) to bypass existing infrastructure bottlenecks.

- The Reality: Israeli Prime Minister Netanyahu paused the approval process in late 2025, linking the gas deal to broader security negotiations regarding the Gaza border and Sinai.

This politicization of the molecule flow breaks the “commercial shield” that has largely protected the Israel-Egypt gas trade from political volatility over the last five years.

Risks: Capex, Counterparties, and Credibility

The immediate casualty of this pause is investor confidence.

- Stranded Capex Potential:

The expansion of Leviathan Phase 1B and Phase 2 requires Final Investment Decisions (FIDs) worth billions. These FIDs are predicated on firm offtake agreements. If the Egyptian offtake is uncertain, the partners (Chevron, NewMed, Ratio) cannot greenlight the upstream capex. The “November 30” deadline was a critical gate for these decisions; passing it without resolution puts the entire project timeline in jeopardy.

- Egypt’s Energy Fragility:

Egypt is already grappling with power shortages. The government had factored these incremental Israeli volumes into its 2026-2030 power generation strategy. If this gas does not arrive, Egypt faces two expensive choices:

- Increase reliance on fuel oil for power generation (higher emissions, higher cost).

- Import more LNG from the global spot market, draining foreign currency reserves.

- The LNG Re-Export Model:

Egypt’s strategy to earn hard currency by re-exporting Israeli gas as LNG to Europe is effectively paused. This denies Cairo a critical revenue stream needed to service its sovereign debt and stabilize its currency.

Upside Scenarios and Strategic Pivots

Is the deal dead? Likely not. The economic logic remains overwhelming for both sides.

- The “Grand Bargain” Scenario: History suggests that energy often becomes the sweetener in larger diplomatic deals. A resolution to the security disputes could see the gas deal approved as part of a broader normalization package. If unlocked, the project could move fast, with the partners likely prioritizing the new pipeline to recover lost time.

- Alternative Routes: This friction may accelerate Israel’s exploration of alternative export routes, such as the long-discussed pipeline to Turkey or a Floating LNG (FLNG) facility. For BD executives, this opens new potential engagement channels: if the Egypt route is deemed too politically risky, technology providers for FLNG could see renewed interest from Israeli operators.

Executive Takeaway

The paralysis of the Leviathan expansion serves as a case study in political risk management. For companies investing in MENA cross-border infrastructure, the lesson is clear: Commercial viability is necessary, but insufficient. Contracts must include robust buffers for political force majeure, and supply portfolios must be diversified. Until the valve is politically reopened, the Eastern Mediterranean remains a high-beta energy market.