The Middle East and North Africa (MENA) region has long been defined by its role as the global oil and gas supply cornerstone. Yet, a fundamental shift is underway: the region is fast becoming one of the most material drivers of global electricity demand growth. New analysis from the International Energy Agency (IEA) provides a critical forecast: regional electricity consumption is set to surge by 50% through 2035, creating an urgent, multi-trillion-dollar imperative for grid modernization and system flexibility.

This is a demand-side shock rooted in demographics and climate change.

The Twin Drivers of Non-Negotiable Demand

The projected 50% growth is equivalent to adding the entire current electricity consumption of Spain and Germany combined. The overwhelming drivers are:

- Space Cooling: Due to rising temperatures—average temperatures in MENA are increasing at more than twice the global rate—cooling already accounts for nearly half of the region’s peak electricity demand. As populations grow and temperatures climb past $40^{\circ} \text{C}$ more frequently, air conditioning becomes a non-discretionary energy load.

- Desalination: Water scarcity mandates the expansion of desalination capacity. Desalination is an energy-intensive process, and its growth is inextricably linked to power market design, forming the core of the water-energy nexus.

In total, cooling and desalination will drive about 40% of the projected electricity demand increase over the next decade. This demand is not flexible; it requires a resilient, high-capacity, and stable power system.

Reimagining the Power Mix: The Shift from Oil to Gas and Solar

MENA’s power mix today is heavily reliant on hydrocarbons, with gas and oil generating over 90% of electricity in 2024. Oil-fired power, while providing necessary peak capacity, consumes $1.8$ million barrels per day (bpd)—a volume countries like Saudi Arabia and Iraq are aggressively seeking to eliminate from their power systems to free up crude for higher-value exports.

Policy and Supply Context: Government policy across the GCC and North Africa is targeting this shift, focusing on natural gas, solar PV, and nuclear power.

- Natural Gas: Gas-fired capacity is set to rise by over $110$ GW by 2035 and will meet roughly half of the projected demand growth. Gas remains the crucial bridge and primary dispatchable source for the foreseeable future.

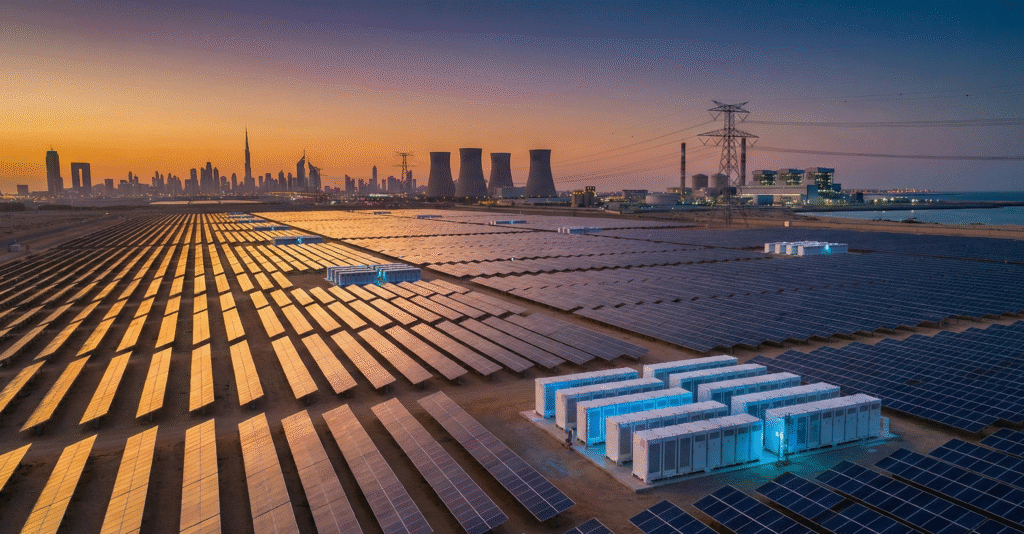

- Solar PV: Solar PV capacity is on course for a tenfold increase by 2035. This massive scale-up is strategically aligned, as solar generation peaks perfectly coincide with the highest cooling demand periods. This move will push the share of renewables in the region’s electricity generation to around 25%.

The Critical Role of Grid & Transmission Capex

The challenge is not simply generating more power, but transmitting, distributing, and balancing it. A tenfold increase in intermittent solar PV capacity demands a commensurate overhaul of the entire grid infrastructure, making this a critical area for C-suite strategic focus and business development.

Risks and Opportunities in Flexibility:

- Grid Modernization: Legacy transmission systems designed for centralized thermal power plants struggle with decentralized, variable renewable energy. Investment is urgently required in smart grid technologies, digitalization, and distribution automation to manage two-way power flow and system stability.

- Energy Storage: Utility-scale battery storage is no longer a luxury—it is a mandatory asset class. It is the key to smoothing out the solar curve and providing necessary ancillary services. Without sufficient storage, the integration of 25% renewables is impossible, forcing reliance on less efficient and more costly ramp-up of gas turbines.

- Cross-Border Interconnections: Projects like the GCC Interconnection Authority (GCCIA) must be fast-tracked and expanded. Interconnections allow countries to pool generation reserves and share solar/wind output, dramatically reducing the required domestic reserve margins and increasing system resilience against peak demand shocks. This is a crucial element for optimizing capex across the region.

The $80 Billion Strategic Upside

The financial stakes are staggering. The IEA projects that if MENA countries successfully diversify their power mix and eliminate oil use for electricity, they will avoid a scenario where oil and gas demand for power generation rises by over a quarter.

Practical Precedent: A successful transition could reduce oil-fired generation to just 5% of the total mix, generating an estimated strategic upside of $80$ billion in increased export revenues. This represents a tangible return on the required grid and renewables capex, framing the energy transition not as a cost center but as a high-return, revenue-optimizing investment strategy.

For business development leaders, the opportunity lies in providing the technological and financial solutions for this systemic shift: sophisticated grid controls, large-scale battery projects, and advanced power management services that ensure resilience while maximizing export value. The next decade will be defined by those who can reliably deliver power market flexibility.

Source 1: IEA: The Future of Electricity in the Middle East and North Africa – Analysis